In a world where convenience defines consumer behavior, Payme has emerged as a groundbreaking financial solution that simplifies how people exchange money digitally. Whether for peer-to-peer transfers, business payments, or instant global remittances, Payme represents the next generation of seamless digital finance. The platform’s vision is rooted in creating a frictionless ecosystem for financial interaction, offering users speed, transparency, and security. Within its intuitive interface, users can send and receive money, manage subscriptions, split bills, and even track spending habits—all within seconds. This article explores every dimension of Payme: its structure, technology, growth potential, and influence on digital economies. From its innovative algorithms to the broader implications for financial inclusion, Payme reflects not just a payment platform but a transformative movement shaping how societies handle value exchange in the digital age.

Understanding Payme: Concept and Core Mechanism

Payme functions as a digital payment platform designed to facilitate quick, secure, and user-friendly financial transactions. Unlike traditional banking systems that rely heavily on institutional intermediaries, Payme operates through a decentralized network that prioritizes accessibility and user empowerment. The platform integrates multiple payment channels—credit cards, bank transfers, e-wallets, and even cryptocurrencies—to deliver flexible options for global users. What makes Payme particularly distinctive is its proprietary encryption protocol, which secures every transaction with dynamic authentication layers. This technology not only enhances safety but also minimizes transaction delays by eliminating redundant verification steps. Users can set up an account in minutes, verify their identity with minimal documentation, and begin transacting instantly. By merging user-centric design with advanced security infrastructure, Payme bridges the gap between financial innovation and practical usability, positioning itself as a vital player in the fintech ecosystem.

The Evolution of Payme: From Idea to Global Platform

The genesis of Payme lies in the vision to democratize financial access and remove the barriers created by legacy banking systems. Initially developed as a peer-to-peer payment tool, Payme soon expanded into a comprehensive ecosystem supporting e-commerce payments, international transfers, and business invoicing. Its developers recognized early on that financial behavior was shifting toward digital immediacy—people wanted control over their transactions without relying on slow, fee-heavy intermediaries. Over the years, the company has refined its technology stack, introducing artificial intelligence-driven risk management, automated compliance tools, and blockchain-based transparency modules. This evolutionary journey mirrors the broader transformation of financial technologies across the world: from mere convenience tools to strategic platforms driving economic participation. Today, Payme’s presence extends across multiple continents, serving individuals, freelancers, and enterprises alike, each benefiting from its intuitive and reliable architecture.

Payme’s Technology Infrastructure

At the heart of Payme’s reliability is a meticulously engineered technological foundation. The system operates on a hybrid cloud network, ensuring that data remains accessible while protected by multi-layer encryption. Each transaction processed through Payme passes through three validation stages—identity verification, risk assessment, and payment authorization—completed in less than three seconds. Artificial intelligence algorithms continuously monitor transaction behavior to detect anomalies, reducing the likelihood of fraud. The integration of blockchain adds an immutable layer of recordkeeping, giving both users and auditors confidence in the accuracy of transaction histories. Payme also employs adaptive scaling to handle high-volume transaction loads without lag. This infrastructure ensures that whether users send a micro-payment or a corporate fund transfer, the process remains consistently fast and secure. Moreover, its open API framework allows developers to integrate Payme into third-party platforms, making it an increasingly essential component in e-commerce and financial software ecosystems.

Table 1: Core Components of Payme’s Technology

| Component | Description | Function in Ecosystem |

|---|---|---|

| Hybrid Cloud Framework | Combines public and private cloud storage | Ensures flexibility and data protection |

| Blockchain Ledger | Decentralized transaction recording system | Provides transparency and traceability |

| AI Risk Engine | Machine learning-based fraud detection | Enhances security and user trust |

| Multi-Currency Gateway | Supports 50+ global currencies | Enables international payments without conversion fees |

| Open API Integration | Developer-accessible programming interface | Expands Payme’s reach across platforms |

The User Experience: Simplicity Meets Sophistication

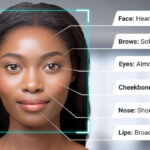

Payme’s interface has been meticulously designed to cater to a diverse user base, from tech-savvy entrepreneurs to casual smartphone users. The onboarding process involves minimal friction—users can register, verify identity, and begin transactions within minutes. A clean dashboard layout displays real-time balances, payment history, and spending insights. Payme’s mobile app integrates biometric authentication such as fingerprint and facial recognition for secure logins, while voice-activated commands simplify navigation. Another standout feature is the ability to create “Smart Groups,” allowing users to manage shared expenses effortlessly. Businesses benefit from customizable invoicing tools and analytics dashboards that monitor cash flow trends. For freelancers and small vendors, Payme’s instant settlement system ensures quick access to earnings. As one financial analyst aptly stated, “Payme transforms financial management from a chore into an intuitive, empowering experience,” capturing the platform’s unique balance between simplicity and technological depth.

Financial Inclusion Through Payme

One of the most profound impacts of Payme lies in its commitment to financial inclusion. Across developing regions, where traditional banking services remain inaccessible or costly, Payme provides an entry point into the digital economy. Users without formal bank accounts can still receive payments, pay bills, or shop online using mobile-based wallets. The company partners with microfinance institutions and local governments to introduce scalable payment solutions tailored to rural users. Payme’s approach aligns with the belief that access to finance is not a privilege but a right. Through its simplified registration and multilingual interface, it lowers the threshold for digital participation. As social entrepreneur Marta Kessel noted, “Financial inclusion isn’t just about giving people access to money—it’s about giving them control, dignity, and opportunity,” a principle that Payme has embedded deeply into its operational model.

Security and Compliance Measures

Security remains the cornerstone of Payme’s success and reputation. The platform employs advanced cryptographic technologies, including 256-bit SSL encryption, multi-factor authentication, and real-time fraud analytics. Every login attempt, device connection, and transaction undergoes behavioral pattern analysis to detect potential breaches. Payme complies with global financial regulations such as GDPR, PSD2, and AML standards, ensuring that users’ data and funds remain protected under strict legal frameworks. In addition, the company maintains transparent communication about its privacy policies, giving users confidence in data handling practices. Regular third-party audits validate its infrastructure resilience, while an emergency fund protection policy safeguards users against accidental losses. Payme’s trust architecture doesn’t merely respond to threats; it anticipates them through predictive monitoring tools. This forward-looking security strategy exemplifies how digital finance can uphold integrity while maintaining speed—a rare balance in modern fintech environments.

Table 2: Payme Security and Compliance Overview

| Security Layer | Description | Compliance Standard |

|---|---|---|

| Data Encryption | 256-bit SSL end-to-end encryption | GDPR, ISO 27001 |

| Fraud Monitoring | Real-time AI behavioral analysis | PSD2, AMLD5 |

| Multi-Factor Authentication | Biometric, OTP, and device verification | PCI DSS |

| Data Transparency | User-controlled privacy settings | GDPR |

| External Audits | Regular infrastructure testing | Global Financial Conduct Authority |

Payme for Businesses and Freelancers

Beyond personal transactions, Payme offers a suite of tools that enhance financial operations for businesses and freelancers. Companies can set up merchant accounts, generate invoices, and accept payments through multiple channels, including QR codes and online checkout integrations. Automated reconciliation systems link payments to invoices, reducing manual errors. Freelancers benefit from low transaction fees and instant withdrawals to local bank accounts. Payme also supports subscription-based billing, allowing creators and service providers to maintain recurring payment models. For e-commerce platforms, Payme’s API ensures seamless integration, enabling customers to pay without leaving the website. Its analytics tools provide insights into revenue patterns, customer behaviors, and refund ratios, helping entrepreneurs make informed financial decisions. By simplifying complex processes like foreign exchange and tax compliance, Payme has become indispensable for modern digital professionals seeking efficiency and transparency in payment handling.

The Global Expansion of Payme

Payme’s expansion strategy underscores its ambition to become a global payment powerhouse. The company has adopted a region-specific localization approach, adapting to currency formats, languages, and legal frameworks. Partnerships with local banks and fintech regulators have accelerated its entry into emerging markets across Asia, Africa, and Latin America. By leveraging regional data centers, Payme minimizes latency and enhances reliability, ensuring that users experience consistent transaction speeds regardless of location. Strategic alliances with international e-commerce platforms and travel service providers have further strengthened its market presence. Its success story reflects a larger trend of borderless finance—where technology dismantles the boundaries that once constrained economic interaction. As Payme continues scaling, its inclusive design and cross-cultural adaptability remain central to its identity, allowing it to resonate with users from vastly different financial and technological backgrounds.

The Future of Payme and Digital Finance

The trajectory of Payme’s growth indicates a future where payments become invisible yet integral to every digital interaction. Innovations such as predictive payments, AI budgeting assistants, and tokenized currencies are already under development within its labs. Payme envisions a world where transactions occur seamlessly within connected ecosystems—whether through wearable devices, smart appliances, or virtual reality environments. Its continued investment in quantum-resistant encryption reflects foresight into future cybersecurity challenges. Furthermore, Payme is exploring partnerships in the renewable finance sector, allowing users to offset carbon footprints through automated micro-donations. This convergence of technology, ethics, and finance signals a shift from transactional systems to experiential economies. As futurist Leo Monte observed, “The real revolution in payments is not in speed or convenience—but in how it redefines trust and participation,” a sentiment that encapsulates Payme’s enduring philosophy.

Conclusion

Payme’s rise symbolizes more than a technological milestone—it represents a paradigm shift in how societies perceive and perform financial interactions. By merging innovation with inclusivity, it bridges the gap between modern convenience and equitable access. Its robust infrastructure, adaptable features, and user-first approach mark it as a leader in the fintech revolution. Payme has not only simplified transactions but reimagined the very fabric of digital finance—transforming payments into a dynamic, personalized experience. As economies increasingly migrate online, platforms like Payme will play a defining role in shaping responsible, transparent, and accessible financial ecosystems. In essence, Payme isn’t merely a payment platform; it is a testament to human ingenuity, proving that financial empowerment, when built on trust and technology, can transcend barriers and create lasting societal impact.

FAQs

1. What is Payme and how does it work?

Payme is a digital payment platform that enables fast, secure, and convenient money transfers globally. It uses encryption technology, artificial intelligence, and blockchain verification to process payments securely while ensuring users can send or receive funds instantly across different currencies.

2. Is Payme safe for international transactions?

Yes, Payme follows global security protocols such as GDPR, AML, and PCI DSS. Every international transaction is protected by multiple verification layers and real-time fraud monitoring, ensuring both speed and safety.

3. Can businesses integrate Payme into their systems?

Absolutely. Payme offers an open API integration system that allows businesses to embed payment functions directly into their websites or applications. It supports invoicing, recurring billing, and automated reconciliation for streamlined operations.

4. Does Payme charge transaction fees?

Payme applies minimal service fees, which vary by region and transaction type. Domestic transfers are often free, while international payments may carry a small conversion or network fee.

5. What makes Payme different from other digital wallets?

Payme distinguishes itself through its global compatibility, AI-driven security systems, blockchain transparency, and inclusive accessibility. It not only facilitates payments but also empowers users with analytics, budgeting tools, and financial control.